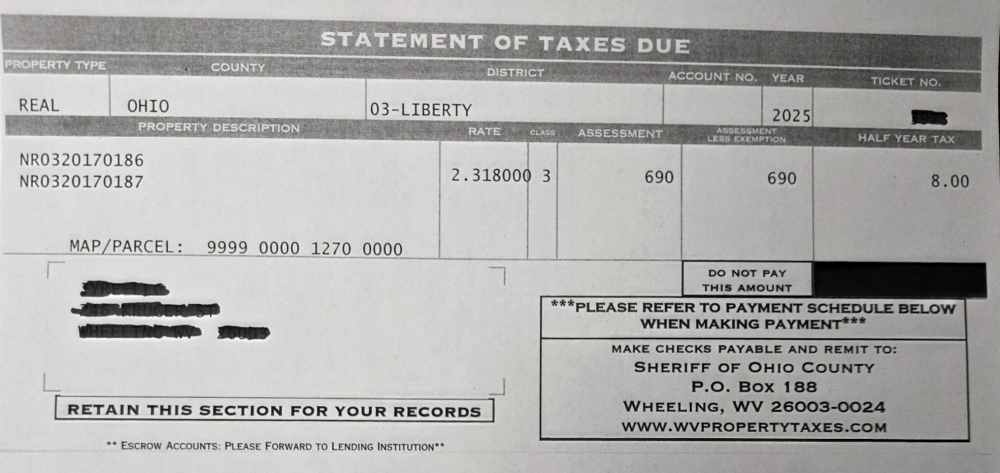

Understanding Your WV Mineral Real Estate Tax Bill

This mineral real estate tax statement is for an Ohio County mineral interest parcel for 2025. Two well legs traverse this parcel, NR0320170186 and NR320170187.

Let's break down the first well-identifying number:

- NR stands for Natural Resource

- 03 identifies the District - 03 is the Liberty District

- 2017 identifies the first year that the Well Production will be taxed

- WV is two years behind on taxing well production, 2017 – 2 = 2015, which means that 2015 is the Year Production started.

- 0186 identifies the Last 4 Digits of the Well API, in this case, it is the Alice Edge OHI 10H (API # - 4706900186)

The API (American Petroleum Institute) number is a unique identifier for every US oil and gas well, specifying the state, county, and well number. The API number for the Alice Edge OHI 10H in our example has the following format:

- First 2 Digits: State Code – 47 is for West Virginia

- Next 3 Digits: County Code – 069 is for Ohio County

- Next 5 Digits: Well Identifier – assigned sequentially within the county. The smaller the number, the older the well.

Refer to the WV DEP page for additional WV API information.

Now that we know what wells are being taxed, we can use the gross production numbers from calendar year 2023 to determine if the assessment is correct.

- The tax levy rate for Ohio County, Liberty District, is 2.318 for 2025.

- Class 3 property identifies the real property as mineral real estate.

- The Assessment Value is 60% of the Appraisal Value. The appraisal value was $1,150. (1,150 x 60% is $690)

- The tax for half a year is calculated as follows:

- 1,150 x 60% x .02318 x ½ year = $8.00

You can use our 2025 Mineral Appraisal Calculator to determine the Appraisal Value.There was $454 in gross royalties in the production calendar year of 2023, the calculator produces a value of $1,148.86 (our calculator is not exact, but it is always real close to the number used by the county assessor).

NOTE: Not all county property descriptions may be portrayed in the same manner as our example.

Contact us if you have questions about verifying your mineral real estate tax appraisal values and tax statements.